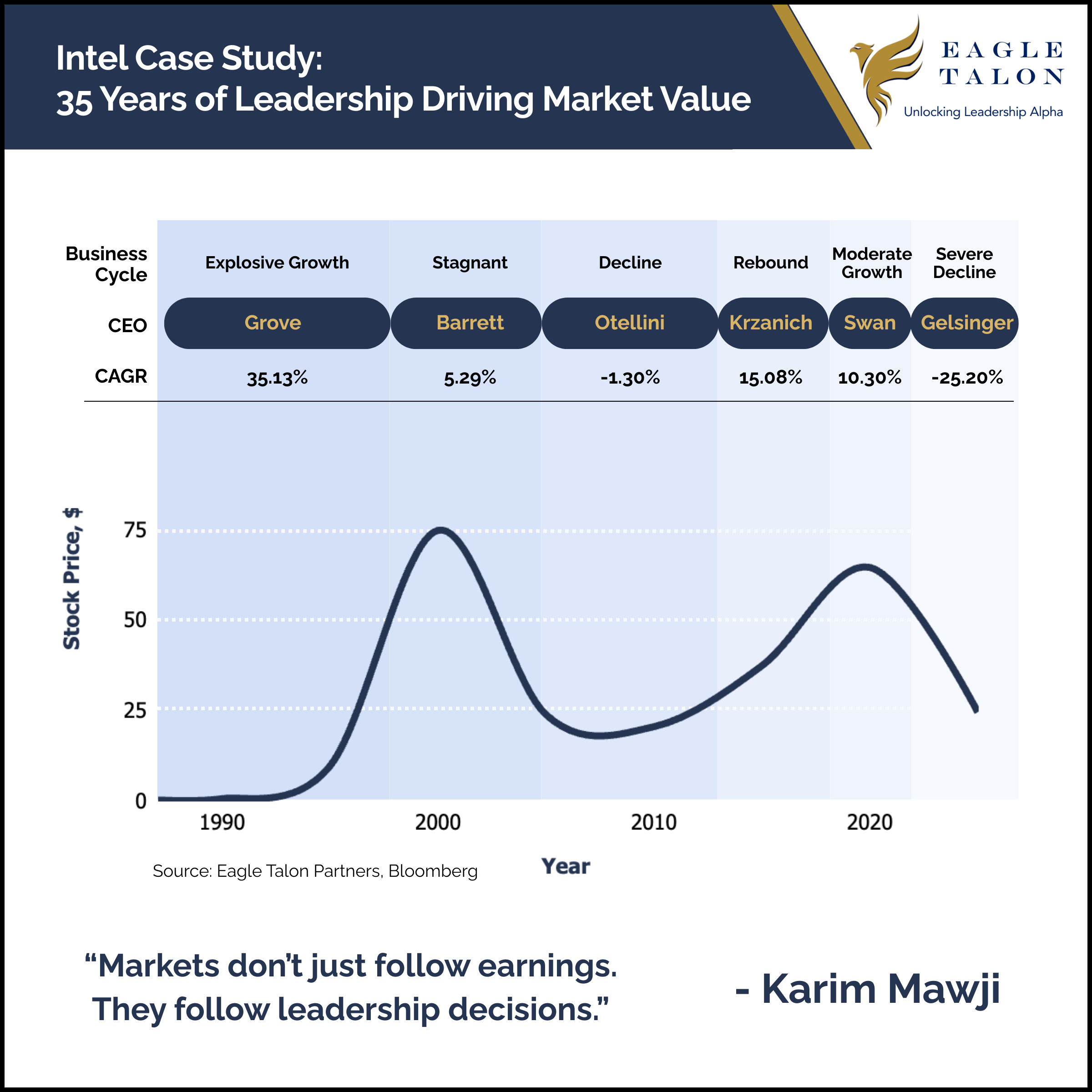

Leadership moves markets. intel is the proof

𝗟𝗲𝗮𝗱𝗲𝗿𝘀𝗵𝗶𝗽 𝗺𝗼𝘃𝗲𝘀 𝗺𝗮𝗿𝗸𝗲𝘁𝘀. 𝗜𝗻𝘁𝗲𝗹 𝗶𝘀 𝘁𝗵𝗲 𝗽𝗿𝗼𝗼𝗳.

Andy Grove (1987–1998): Intel’s golden age. Market cap soared +4,500% as he built the backbone of the PC era. Discipline, focus, and execution made Intel indispensable.

Then came drift:

→ Success bred complacency in the 2000s. Mobile was missed. Diversification blurred focus. Competitors surged.

→ Strategy faltered in the 2010s. Manufacturing delays and leadership churn gutted trust. Apple’s exit signaled the erosion of Intel’s edge.

→ Pat Gelsinger’s return raised expectations — but years of underinvestment and indecision weighed heavier than optimism.

Now Lip-Bu Tan inherits the challenge:

→ Cost discipline isn’t enough.

→ Restoring competitiveness requires more than restructuring.

→ Investor trust will follow leadership clarity — or vanish.

The lesson is constant:

→ Markets don’t just follow earnings.

→ They follow leadership judgment.