Top credentials don’t guarantee top performance

Top credentials don’t guarantee top performance.

Anyone who has invested in public companies long enough learns this quickly.

What actually separates CEOs who scale from those who stall isn’t the résumé — it’s fit.

Fit to the environment the company is operating in.

Fit to the stage of growth.

Fit to the level of complexity the business can absorb.

And when that fit is off, the business always pays first.

What we see repeatedly at Eagle Talon:

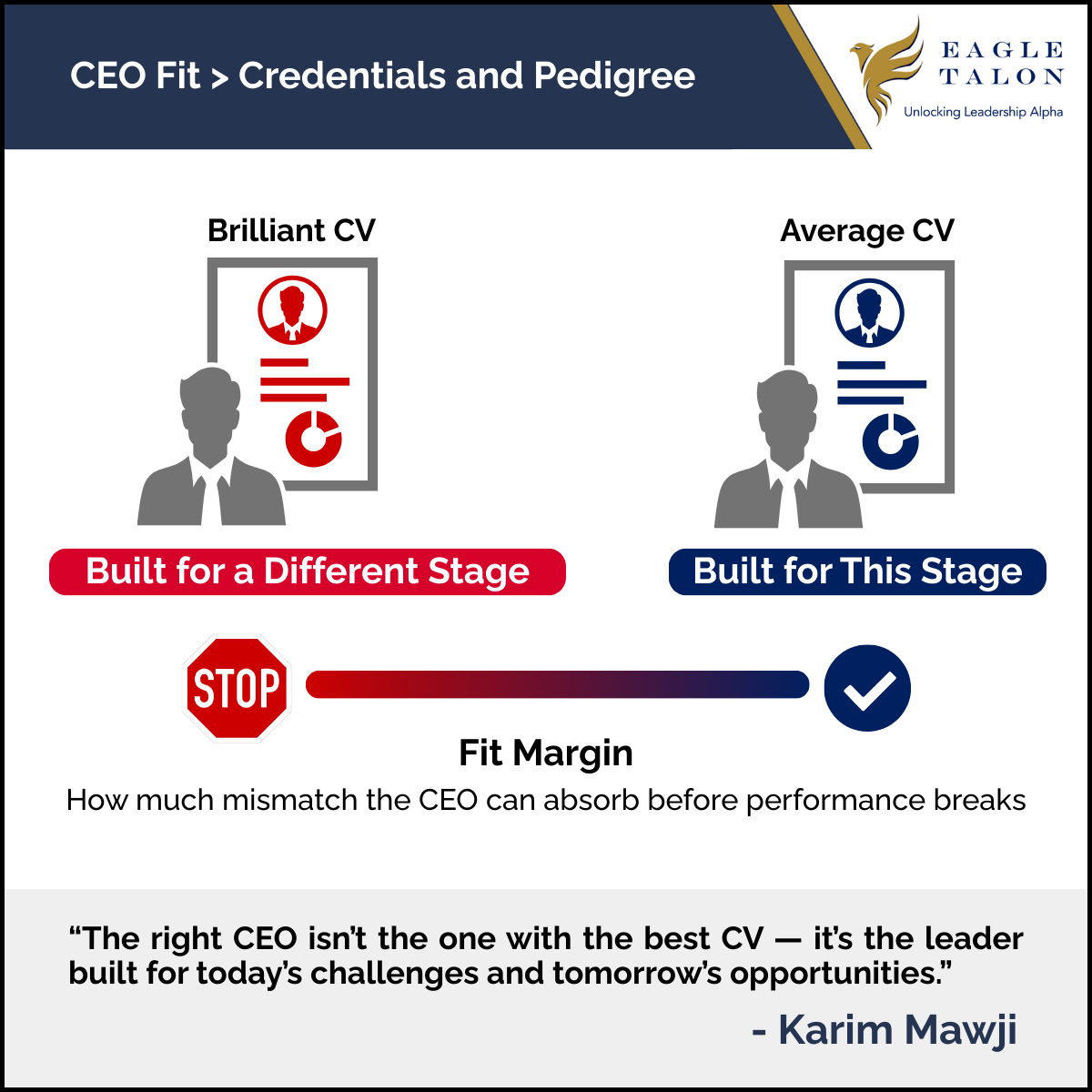

➤ The real variable is the “fit margin” — how much mismatch a CEO’s style and skills can actually absorb before it erodes performance.

➤ Investors routinely underprice mismatch risk, even though it compounds quietly long before it shows up in the numbers.

The pattern is consistent:

A CEO with a brilliant background — but misaligned to the company’s stage — can burn through capital and slow momentum.

Meanwhile, a CEO who looks “average” on paper — but whose judgment fits the moment precisely — can adapt, scale, and outperform every expectation.

So here’s the question I keep coming back to:

Which mismatch do you see more often today —

CEOs built for a different stage than the one their company is in (brilliant resumes but the wrong context),

or

CEOs whose judgment and skill set match what the job requires — but who haven’t yet operated at this level of scale and complexity?